by

Eric J. Feldman

Do you use terms such as Algorithm, Agile Development, Big Data, BYOD, Container, Cross-Platform, DevOps, DNS, HTML, Phishing, SaaS, TCP/IP, or WPA/2 in everyday speech?

If you are in a corporate finance department, chances are that you may have seen these terms, but they are not within the scope of your day-to-day job. Finance speaks a vastly different language, with balance sheet, budget, capital expenditures, cash flow, income statement, overhead costs, return on investment, and value stream being more common terms.

If you are in a corporate finance department, chances are that you may have seen these terms, but they are not within the scope of your day-to-day job. Finance speaks a vastly different language, with balance sheet, budget, capital expenditures, cash flow, income statement, overhead costs, return on investment, and value stream being more common terms.

But what about those people in IT financial management (ITFM) or Technology Business Management (TBM) roles? They often work across both IT and finance departments. How do they translate the “geek” to a dialect that will be understood by business decision makers?

While this difference in language is not new, it seems surprising since IT expenditures are among the highest expense item for many businesses. And total IT spending grows every year and shows no sign of slowing down, with a forecast from Gartner that worldwide IT spending will reach almost $3.9 Trillion in 2020.[1]

All this IT spending creates a huge need for every organization a form of IT reporting known as “IT Storytelling.” This is not just compiling numbers on a spreadsheet or flashing data in a conference room presentation. It is about telling a story about why investments in technology should be or were made, along with the expected benefits, value, and ROI to the business in the language they understand. In other words, the language of finance, not geek.

The Language of Corporate Finance

What are examples of the “language of corporate finance?” It’s not just about numbers, but also concepts such as value creation, sales, return on capital, market expectations, and cash flow. Some of this language of corporate finance can be summarized in the “four principles to help make financial decisions” by McKinsey and company[2].

- The core-of-value-principle – the concept that value creation is a function of returns on capital and growth

- The conservation-of-value principle – creation of value is about improving cash flows, not financial engineering

- The expectations treadmill principle – a company’s stock price is more about is more about market expectations about performance, not only actual performance

- The best-owner principle – a business has a different value to different owners based on how it is managed and their overall strategy

IT Storytelling

Several years ago, I was in a meeting with the CIO of a tire manufacturer. The sales team I was with was explaining the benefits of a technology we were proposing. The CIO after listening to our presentation said, “all this sounds terrific, but how will it help me sell more tires.”

This example is a classic case of the need to communicate to the business how an IT capital spending investment proposal provides a return for the company. And to justify the investment, a knowledge of how the company creates value and how the proposal is linked to the value stream is vital.

That tire company never did make an investment from the sales team’s proposal. We failed to speak the language of finance, especially following the “the core-of-value-principle” or the “the conservation-of-value principle” as outlined by McKinsey. We could not tell the story in the language of the CIO of how the proposal would improve their cash flow. As a result, this person did not have the appropriate information to make a business decision.

Understanding the Value Stream

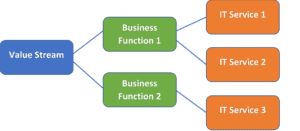

Value streams are the entire product or service creation pipeline across the organization that encompasses all the value the company delivers. Think of the value stream as the people, process, technology and materials that are combined to create an offering.

Value streams are the entire product or service creation pipeline across the organization that encompasses all the value the company delivers. Think of the value stream as the people, process, technology and materials that are combined to create an offering.

In many industries, IT services are in integral part of from their value stream, especially technology heavy industries such as banking and manufacturing. And just as a piece of equipment may be used to produce more than one type of part, an IT service often supports more than one business function in the value stream.

Understanding how your IT organization fits into the value stream is a good first step towards speaking the language of business. If you would like to take the next step in learning how to speak the language of corporate finance, be sure to read our White Paper, “Translating IT for Finance and the Board.”

Written in conjunction with our partner Thavron Solutions, this whitepaper will help you think more strategically about the IT functions and the IT budget as well as how to make communicating those with the organization more effective.

Be sure to read “Translating IT for Finance and the Board” today!

[1] Gartner Press Release, “Gartner Says Global IT Spending to Grow 3.7% in 2020,” October 23, 2019. https://www.gartner.com/en/newsroom/press-releases/2019-10-23-gartner-says-global-it-spending-to-grow-3point7-percent-in-2020

[2] “The CEO’s guide to corporate finance.” Richard Dobbs, Bill Huyett, and Tim Koller. McKinsey Quarterly. November 2010. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-ceos-guide-to-corporate-finance