Budgeting in excel for mid to large IT departments is tedious, time-consuming and error-prone. Yet why are so many still doing it? There are several reasons, but none are good and sound more like excuses. The ones we hear most are, “This is the way we always did it,” and “Everyone knows how to use excel.” I can imagine many of you are giving similar excuses as well; however, do you realize there’s a much better alternative?

Solutions that provide budgeting beyond the spreadsheets are available to help. Today’s IT environment can use these to gain greater insight into their management team about unit cost, capital versus operating expense and fixed versus variable cost, just to name a few. Organizations are able to provide an easy to use forecasting capability that reduces the time it takes each month for financial analysts to create new forecasts for their management team. Adding a solid robust analytical tool on top of the budgeting solution makes it even better. This combination is usually found as part of an overall IT Financial Management Solution. According to Gartner, “Tools designed to enhance the effectiveness of IT financial management have evolved significantly in the past few years, making them a sound investment for organizations that need better IT cost transparency.”[1]

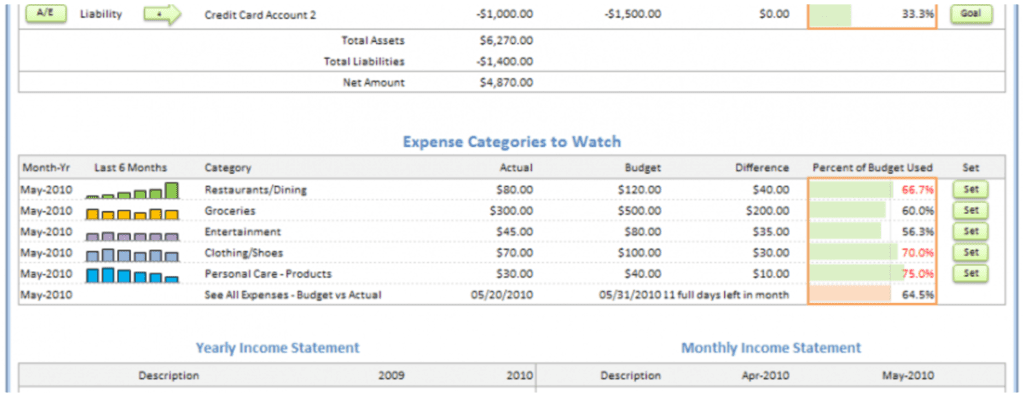

Graphic analytics from an ITFM solution provide a clear picture of gaps between budget and actual costs, which drives better business decisions and better accountability throughout an enterprise. The information is relevant, accurate and up to date as it comes directly from the corporate ERP or Ledger systems. This can be designed for either a standard view or customized reporting to adapt to changing needs. It empowers managers to investigate on their own and drill down to more detail making the entire process completely seamless and self-serving. Most importantly, graphic analytics removes the reliance on excel spreadsheets and the inherent issues that trying to manage spreadsheets on a single desktop can bring.

The other great benefit that deploying a better budgeting and forecasting solution brings to your organization is that it informs those team members in non-financial roles about the importance of managing and understanding the numbers. Better factual decisions can be made due to the nature of the insightful information being presented.

Another challenge to using excel-only processes comes alive during the inevitable end of year planning process. At this particular time of year, you may be in the midst of your twenty-seventh or some number of iterations to your planning process for those managing to a calendar year budgeting cycle. I can almost hear your CIO claim, “When are we going to improve this process?” IT departments most certainly are experiencing added anxiety. In order for the rest of the business to plan, the various departments need to know what IT costs will be trickled down to them or in more mature organizations who are using a chargeback approach, what will be their exact consumption costs. By using a financial management solution that has a strong budgeting and forecasting capability, the planning process becomes streamlined and more inclusive to the IT managers and their consumers. Everyone benefits. We can show you how.

Mature IT financial management firms – those who build a solid baseline of their costs that are easily shared among their IT managers and are updated monthly with actual costs in order to track the progress of one’s plans – better map costs to the IT resources their business units consume. This is the most critical data gathering step in the process of transforming your IT financial process from an IT peanut butter spread allocation to one that is more consumption and cost-based. While it takes hard work and a thorough understanding to do this, it’s much easier to accomplish once you have a solid foundation of your IT costs.

With the right IT financial management software, your IT organization can replace an error-prone excel process with one that is efficient and offers greater line of sight to unit-costs, IT spend, cost reduction plans and project costs. IT becomes a collaborative partner throughout the planning and budgeting process.

[1] Gartner, “Best Practices in Implementing IT Financial Management Tools.” January 27, 2012.

Photo credit: www.georgesbudget.com