A recent report from Merkle on shopper expectations surveyed over two thousand shoppers to learn how they interact with retailers. This report covers how consumers currently interact with brands and how they hope to engage with brands in the future. My three takeaways from the report are that mobile is on its way to being fully integrated into the customer journey; email and store associates are still essential, but text messaging programs are becoming increasingly popular; and loyalty programs are on their way to becoming extremely effective for brands.

Mobile throughout the customer journey

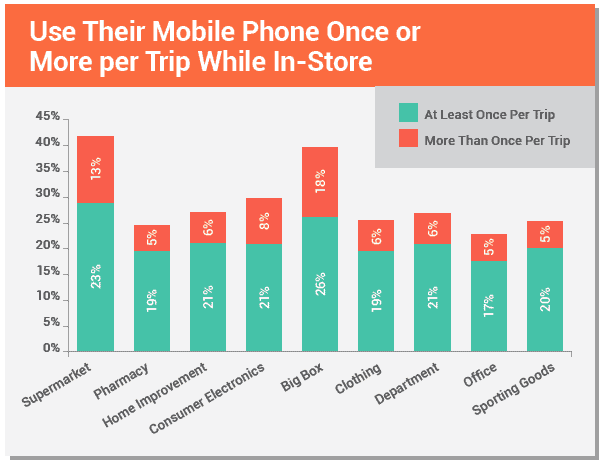

Year-over-year, mobile web traffic, mobile transactions, and customers using mobile devices while in-store continues to rise. Just as many customers start their shopping on a mobile device as they do on a PC. Considering over 67% of consumers reported an interest in a totally mobile path to purchase, brands should make a substantial effort to enhance their mobile web experience. Consumers need a full-fledged mobile experience that allows them to research and purchase a product from their mobile device.

Mobile Phones are Research Tools, Especially In-Store

Once in store, roughly half of consumers use their phones to research products before purchasing. Between 20% and 30% of consumers engage in pricing related activities such as comparing prices, managing coupons, or quickly searching for online coupons. Considering mobile coupons are redeemed eight times more than paper coupons, it is essential that brands create mobile versions. In addition, 46% of consumers indicate a willingness to receive personalized offers on their phones while shopping in-store. This means that nearly half of in-store customers looking to purchase might opt-in to a mobile text program to receive a coupon.

In addition to comparing or reducing the price, 15%-20% of customers check reviews, research products or use a shopping a list. Showrooming requires products to maintain an excellent online review rating in order to stay competitive. Overall, it seems clear that consumers see their mobile device as a research tool, coupon manager, and purchasing tool. In-store shopping is only a small portion of the customer journey. Interacting with customers on the right channel, with the right message, at the right time is what has the highest impact on increasing customer lifetime value.

Interaction with Brands

It’s clear that everyone uses their mobile device to learn about brands whether they are shopping at home or in-store. But when brands want to reach out to shoppers, what is the preferred way to interact?

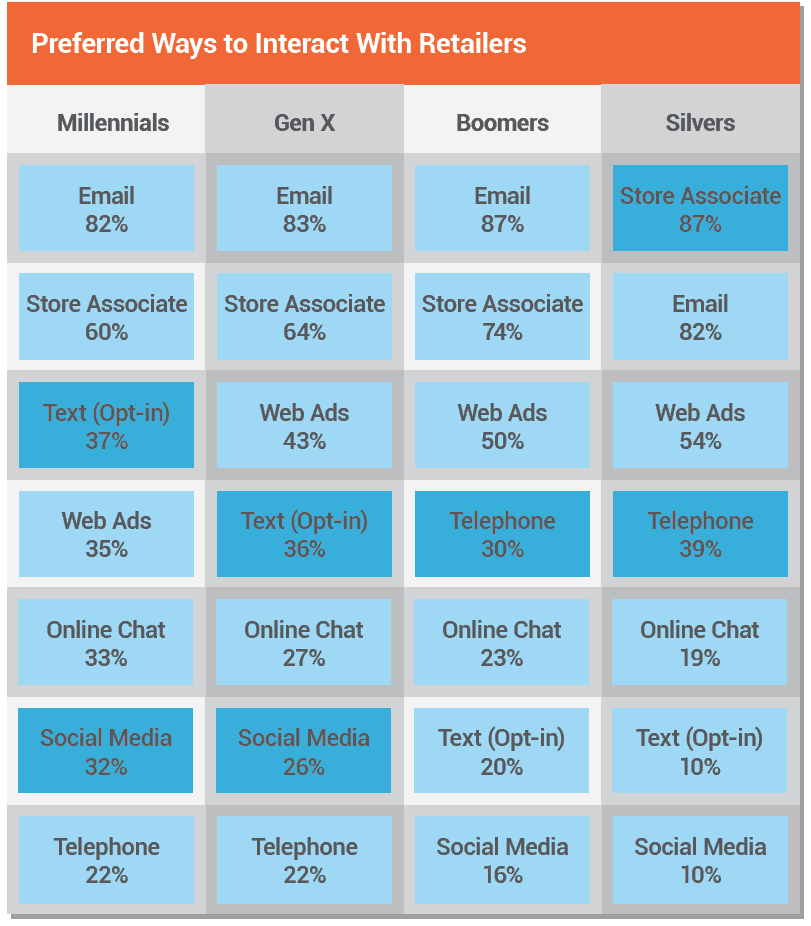

In the world of retail, email remains king. Millennials, Gen X, and the Boomers most consistently list email as a preferred channel of interaction with a retailer. Only the Silvers, more consistently list store associates as a preferred channel. Despite email’s dominance, roughly half of customers surveyed indicated that they find “occasional value” and 40% said they receive “way too much” email. Retailers need to reduce the frequency of emails and increase the value per email interaction. This can be accomplished with more tailored offers that are sent less frequently. The report provided interesting take aways regarding text messaging programs:

- Text (opt-in) was preferred by more people than social media for every generation

- Millennials would rather interact with a brand over text (opt-in) than Web Ads

- Millennials & Gen X would rather interact with a brand over text (opt-in) than online chat

It really stood out to me that all age groups, including social media crazy millennials, would rather interact with retailers via text programs than social media. Yet the time, energy, and resources devoted to social media programs is often much larger than text programs. I think one of the reasons consumers prefer to interact with brands over text vs. social media is due to the private nature of text.

People want personalization, but not that much

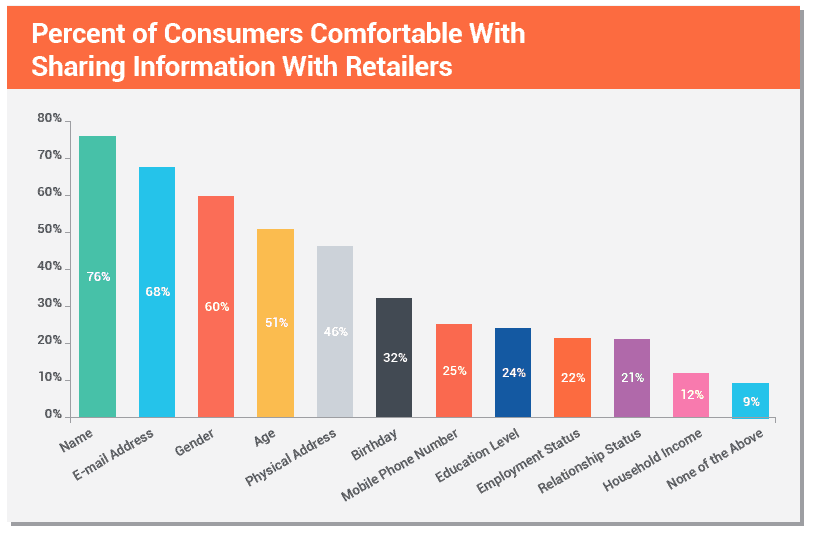

Personalization has become a very delicate balancing act. On the one hand consumers are sick of broad sweeping, irrelevant offers. On the other hand, data security breaches and privacy issues have become such a concern that consumers are hesitant to share. We highly recommend that brands take the time to create a dialogue between the brand and the consumer where consumers receive a benefit for sharing their info. The acceptable items to ask for, where more than 50% of consumers are comfortable sharing, are name, age, email, and gender. The riskier items, where below 50% of consumers are comfortable sharing, are birthday, physical address, and education level. Take a look at the chart below to get a better sense of which pieces of data consumers feel comfortable sharing.

Loyalty Programs

One of the most interesting sections of the report dealt with loyalty programs. Most loyalty programs are meant to keep customers engaged with a brand so that they continue to shop with them. Despite such a large number of retailers having loyalty programs, less than 20% of consumers say loyalty programs are a main factor in choosing where they shop. Additionally, half of loyalty program members drop off after their initial enrollment and only 44% of loyalty program members are active.

This shows that initial offers and discounts encourage customers to sign up, but the news, promotions, and events are not personalized or engaging enough to keep loyalty program members hooked.

Recommendations for retailers

Based on the findings in this report, I would recommend the following steps for retailers:

- Reduce the frequency of emails sent

- Align any webform signups to loyalty programs or brand advocacy programs to collect the information that the majority of customers feel comfortable sharing

- Promote in-store text message opt-in programs to engage customers searching for discounts

- Use customer supplied information to further personalize email, sms, and app-based marketing to promote only the most relevant offers

- Diversify your loyalty program. Don’t just provide transaction centric promotions. Instead, create engaging content, exciting brand experiences, and preferential treatment for VIP customers.

If you are curious about how retailers are using SMS to drive in-store traffic, increase basket -size, and enhance their loyalty programs check out this eBook on Mobile Messaging for Retailers.