If you read my last post, you’ll recall the desperation in the room when our marketing team took a hard look at engaging enterprise companies. And you’ll recall that our response wasn’t to assume we knew content those buyers would want, but to conduct actual research first.

A quick recap: The goal of our research was to understand why our buyers consume particular content, what kinds of content they want (and where they go to get it), and how they actually frame their challenges and accomplishments.

We knew no one tactic would get us all these answers, so we devised a three-prong strategy involving a survey, content scoring, and LinkedIn semantic analysis.

In this post, I’m going to detail how we approached building and deploying our survey.

I see you yawning there. Hold on. Let me explain.

The survey is a classic workhorse of marketing. And for good reason; it’s direct and straightforward. But to get real answers, you have to be careful how you pose the question.

To get real answers, you have to be careful how you pose the question.

We asked 8 questions that particularly got to the heart of our buyers’ interests. I’m going to run through these, explain why we asked it, and what lessons the answers provided.

1. How much time do you spend consuming content?

Here’s how we actually framed that question: “On average, I spend ______ hours per day engaging with industry-based content such as: blog posts, news articles, eBooks, whitepapers, videos, podcasts, etc.” The answer choices were between 0 and more than 5 hours.

This is important because we’re trying to get a sense of our prospects’ attention span. Are they voracious readers? Do they squeeze in articles and podcasts between meetings? How they reply here frames how we approach content production, what level of mix between lengthy and short-form assets we need to create.

But these self-estimates are often unreliable on their own, which is why we also asked the next question.

2. Are you sure about that?

Reality checks are a crucial part of the inquiry process. We threw in some of our own to help frame the conclusions we made from the survey results.

Nearly half of respondents said they spend 1-2 hours digesting industry-relevant content.

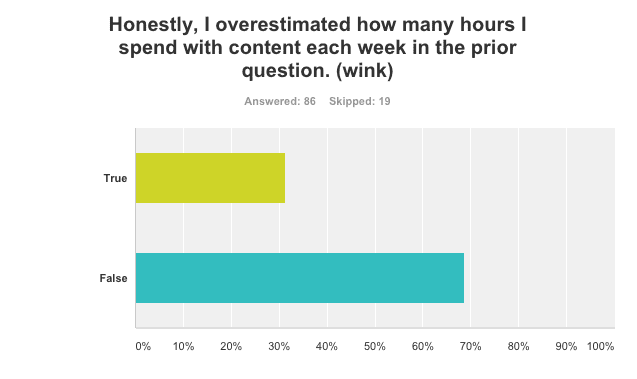

So after we asked enterprise marketers how many hours they dedicated to consuming content, we followed with this question: “Honestly, I overestimated how many hours I spend with content each week in the prior question. (wink)”

The responses were telling. Nearly half of respondents said they spend 1-2 hours digesting industry-relevant content. Another 27% claimed they spend 2-3 hours on content. But when asked if they overestimated their consumption habits more than 69% said they probably did.

These kinds of questions are like speed bumps. They make the respondents slow down and think through their responses. This ensures a more realistic framing of the data collected.

For instance, we saw that the consumption habits of these marketers were more aspirational than reflective of their daily lives. They wanted time to read articles, listen to podcasts, and watch videos, but didn’t have as much time as they’d like. That allows us to know that our target buyers want insightful content, but have little time to consume it.

The takeaway for us was that we need to build a relationship with enterprise marketers by offering summarized, shorter content, then offer more in-depth assets once they’ve shown real engagement.

3. Who do you trust?

The honest truth is that we scan through dozens—if not hundreds—of headlines every day. We might even “engage” with much of this content (i.e. open, click, etc.). But that isn’t necessarily indicative of a positive signifier of influence.

So we asked enterprise marketers to rank who they trust most from a series of common content sources: analyst sites and blogs, digital media outlets, traditional print and broadcast outlets, corporate blogs and websites, and the blogs or sites of independent thought leaders. The responses were clear.

Independent thought leaders were far and away the most trusted resource.

Analysts and traditional outlets were a distant second and third, and corporate blogs were dead last.

The takeaway for us wasn’t to dump our blog, but to build up credibility through influencers and analysts that, over time, could be extended to our own content. It drove our focus outwards and inwards, but gave us a sense of where we could let off the gas and where needed to put the pedal to the medal.

4. What’s your preferred way to consume content?

Theme matters more than format. A strategy dictated by tactic isn’t a strategy at all. But that doesn’t mean format doesn’t matter.

We asked survey takers to rank their preferred methods for consuming content. The idea was to have that inform how we deliver against specific themes and buyer concerns.

The top three were blogs, whitepapers, and infographics. That’s some pretty intriguing data if you think hard about it. Each represents a different layer of intensity, from the very dense to the quickly consumed. Our content would have to stretch this gamut—ideally in each campaign—to be successful.

5. What’s your preferred way to share content?

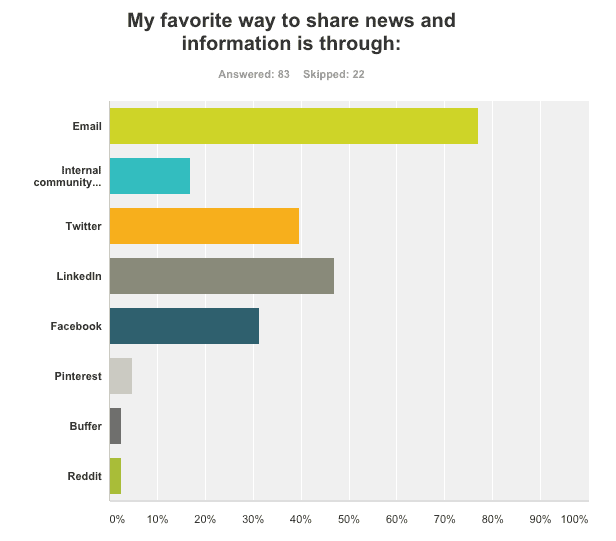

I mentioned before that clicks and opens doesn’t necessarily equal trust. But sharing behaviors are an indicator of value. If one of our target marketers thinks enough of an article or eBook to share it, we can assume some value has been assigned to that content.

So we asked these marketers to select their preferred method for sharing news and information. The results were surprising.

Email was the definitive winner at 77%. Several social networks arose (LinkedIn, Twitter, and Facebook were the 3 highest in that order), but email is still dominated the “preference” category for enterprise marketers.

This had immediate implications for us. First, we added an email sharing option to all our blog posts and are in the process of adding it to all landing pages. Additionally, we wanted to encourage more email subscriptions. So we created an added incentive to subscribe to our blog by offering a free eBook on modern blogging best practices in exchange for signing up to the weekly newsletter.

6. Where do you go for industry news and analysis?

Content marketing isn’t just about production, it’s also about distribution. We put a lot of time and resources into building our owned channels, mainly because these will be both our immediate and long-term growth drivers. But once that investment is made, you need a strategy for generating earned media as well.

We felt this survey would help us pinpoint exactly which outlets will most likely end up in the queue of enterprise marketers. And the results contained a mix that, frankly, surprised us. The way we came to the list of the top ten outlets was by providing a substantial list of choices including blogs, traditional, and new media channels.

The relative order of this list actually shifts when you do a more granular segmentation. For instance, Forbes slides from a first place position among companies with 5,000 or more employees to the eighth slot among companies with 1,000 to 5,000 employees.

The sweet spot are those outlets which remain constant across both segments. But all of the top performers deserve particular attention in our PR efforts.

7. Which social sites do you look at most?

Social media is a big driver for traffic to our web properties. And when I say “big,” I mean as much as 30% to 40% of monthly traffic. Obviously, we want to concentrate on social sites that are most relevant to this important audience of potential buyers.

In the survey, we asked the marketers to rank social media platforms by how frequently they visit them. Frequency, we felt, was a better determination of effectiveness than asking them to list their “favorites.”

LinkedIn ranked first, followed by Twitter and Facebook. Interestingly, StumbleUpon was prominent in a secondary choice for a many marketers. This suggest that the big 3 remain prominent, but there are corners yet to be exploited—and they’re not always the hot new thing.

8. Do you like playful or data-heavy content?

The enterprise is a serious place, so enterprise marketers want serious content, right?

Not necessarily. At Kapost we have a lot of fun with our content, but we also provide a lot of data. As we approach a larger number of enterprises, we wanted to see if preferences skewed one way or another.

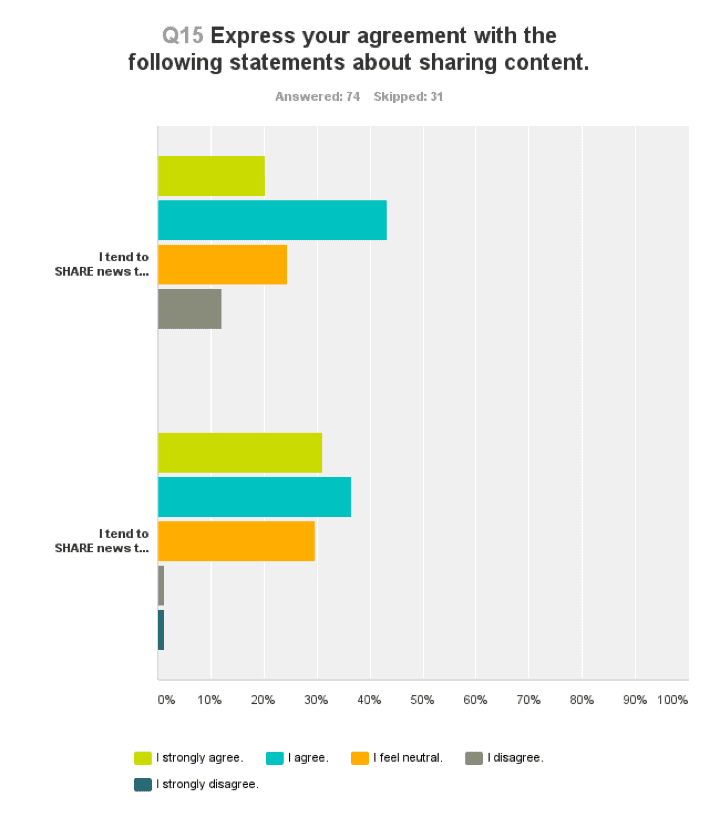

We asked marketers if they preferred to share news that was “playful” or “data-heavy.” (You could choose both, but had to rank on a spectrum of “strongly agree,” “agree,” “neutral,” “disagree,” and “strongly disagree.”) The results are both.

63% said they share factual content and 67% share content with a playful tone. The gulf widens when you look at those who strongly agreed with either statement, however. 31% strongly agreed that they shared playful content while 20% agreed they shared data-heavy material.

Clearly, we need to provide fact-driven assets. But you can’t discount the value of expressing personality in content, especially among the enterprise.

The survey data gives us a substantial jumping off point for structuring our marketing efforts as we swim upmarket. It’s one leg of the three-prongs of research we did to understand our audience. Alone I’d argue the survey is interesting, but doesn’t give the full picture.

For that, stay tuned here as we’ll detail the two other areas of research we performed.