Mobile banking apps might be ubiquitous these days, but Bank of America has been leading the pack from the get-go. Since setting up its mobile banking capabilities 10 years ago, Bank of America’s focus on putting mobile banking at the center of its go-to-market strategy has paid off. Not only was it named first in S&P Global Market Intelligence’s 2017 mobile bank app ranking, its mobile banking platform now also has 23 million users.

Over a space of four months this year, mobile banking customers logged into their accounts 1 billion times, made more than 30 million mobile bill payments, and nearly 11 million person-to-person (P2P) transfers. That’s an 89 percent increase over 2016. Customers also used their mobile devices to deposit more than 340,000 checks every day.

The focus for Bank of America in recent times has been to reduce costs, divest itself of products that weren’t meeting consumer needs, and focus on customer satisfaction. More specifically, in technology and mobile banking.

“It was important that we set a clear strategy — a strategy that we are going to be customer-driven in everything we do and if we were in activities that customers did not need us to be in, we aren’t going to do it,” said CEO Brian Moynihan. “We’ve continued to invest in the areas we can grow. $3 billion in technology-related growth initiatives, especially in areas of digital practice, whether it’s in Consumer Banking, Commercial Banking, where we lead the industry with mobile and online platforms.”

Bank of America’s mobile-focused strategy has paid off. It ranks second only to JP Morgan Chase in terms of the number of active mobile customers and places above Wells Fargo. The number of customers opening new accounts through mobile has increased a huge 47 percent over the past year.

Focusing on the customer

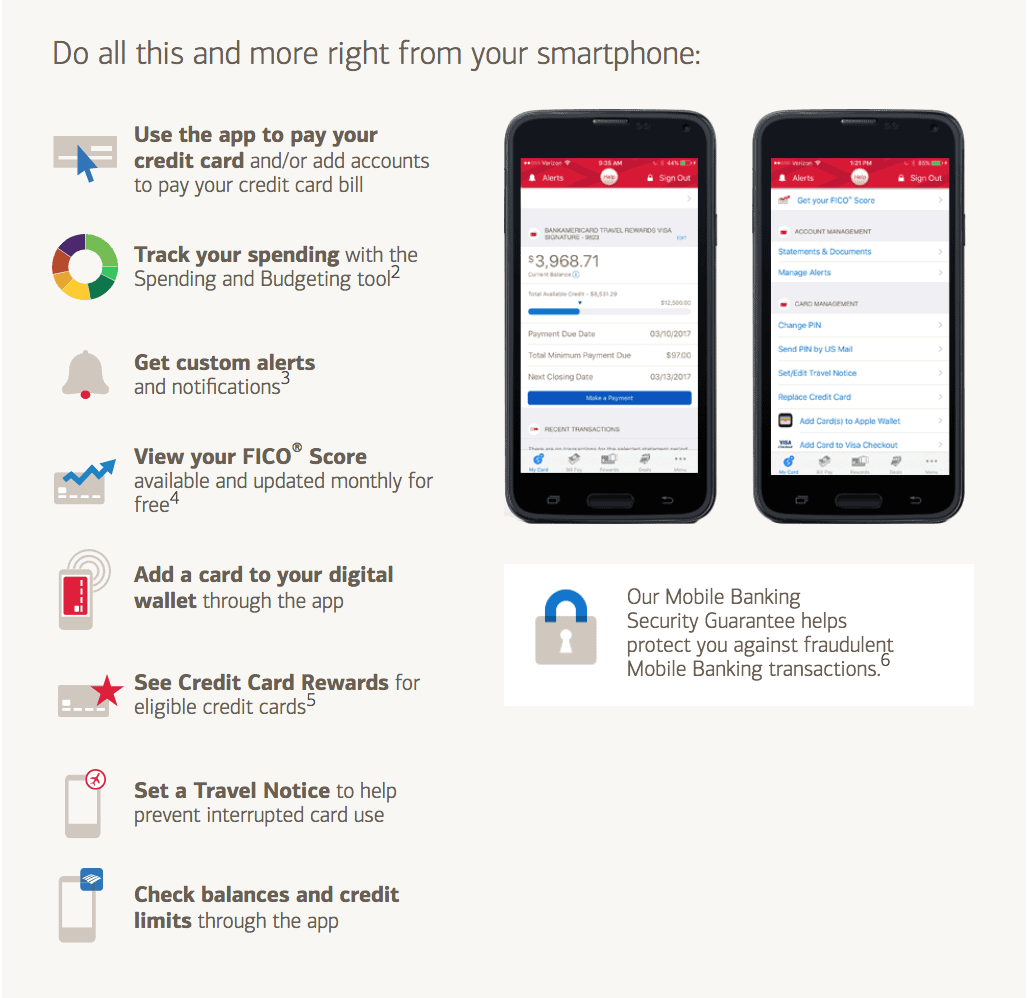

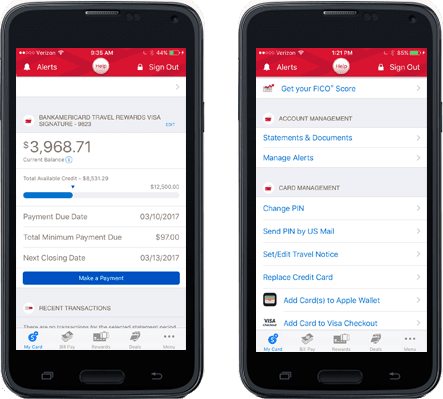

Its mobile-first focus means Bank of America is constantly innovating in the mobile-banking space, with Head of Digital Banking, Michelle Moore, saying in 2017 that customers will see a “strong focus on payments and intelligent solutions that will deliver personalized experiences clients never imagined were possible.” Some of those solutions include setting and editing travel notices for eligible cards, depositing checks by simply taking a photo, and receiving alerts for important account and security information. However, that’s not all. Here are some more of the innovative features BoA mobile customers are using.

Cardless-enabled ATMs

Bank of America has one of the largest cardless-enabled ATM networks with 10,000 of them currently available to customers. Customers can start an ATM withdrawal from their mobile banking app by logging in and selecting a cash amount. When they arrive at the ATM, they can either use their smartphone or debit card to initiate the transaction. They then simply have to enter their PIN, which prompts a personalized screen asking them if they are here to complete the withdrawal. The focus is on efficiency as it eliminates four steps at the ATM. Users can also check balances, transfer funds, make deposits and credit card payments, and change their PIN.

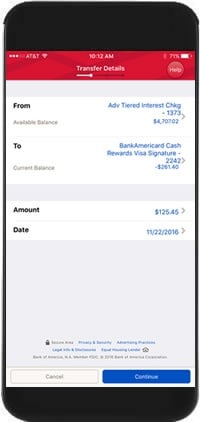

Person-to-person pay

One of the most popular new features is person-to-person (P2P) pay. Users can send, receive, and request money to or from almost anyone within minutes, regardless of where they bank. The app uses existing contacts on the mobile device to securely transfer funds. Another feature of P2P that’s proving useful to customers is the ability to split expenses among people. A group of friends can split a dinner check, for example, and can even add a personal note to accompany the payment transfer or request.

Fingerprint and Touch ID sign-in

Android, iPhone, and iPad customers can use fingerprint and Touch ID sign-in to log into the mobile phone banking app using their fingerprint. Just as Apple’s fingerprint access is second nature to most users, Bank of America’s customers are adopting it fast. It’s a secure and convenient way to log in and allows users access to the app’s most common functionalities without the need for a passcode.

Mobile dashboard

The app’s dashboard has been designed to give customers a quick snapshot of their finances all in one place. Users can customize tiles to show the features they use most, such as account balances, card rewards, the spending and budgeting tool, and person-to-person.

Getting assistance

Customers can connect to Bank of America’s call centers and branches from their mobile devices. They don’t have to re-authenticate, because the credentials from the phone’s app are transferred directly to the call assistant’s desktop. From zero calls a year ago, Bank of America now handles 150,000 calls a week this way. Mobile users can also use the “Add to Calendar” option, which populates any appointments to the personal calendar on their device.

Goal-setting tool

Last, but certainly not least, Bank of America’s goal-setting tool has been rolled out to help customers achieve their financial goals. Customers can create personalized savings goals with names, pictures, and target amounts so that they can watch their progress along the way and prioritize their funds accordingly.

What’s coming next?

Bank of America has announced it’s going to start implementing Intel Online Connect technology into its online banking platform. It plans to incorporate biometric authentication to its online banking processes in 2018, and will be the first financial services company to offer it to customers.

Mobile banking isn’t just the future, it’s the present, and with 62 percent of Americans using a mobile banking app, up from 54 percent in 2016, it makes sense to focus investment in technology and solutions that build on mobile platforms. Bank of America has not only been successful, it has also made its intentions clear: Customer experience is number one, and there will be more innovative advancements in the mobile banking space to come.