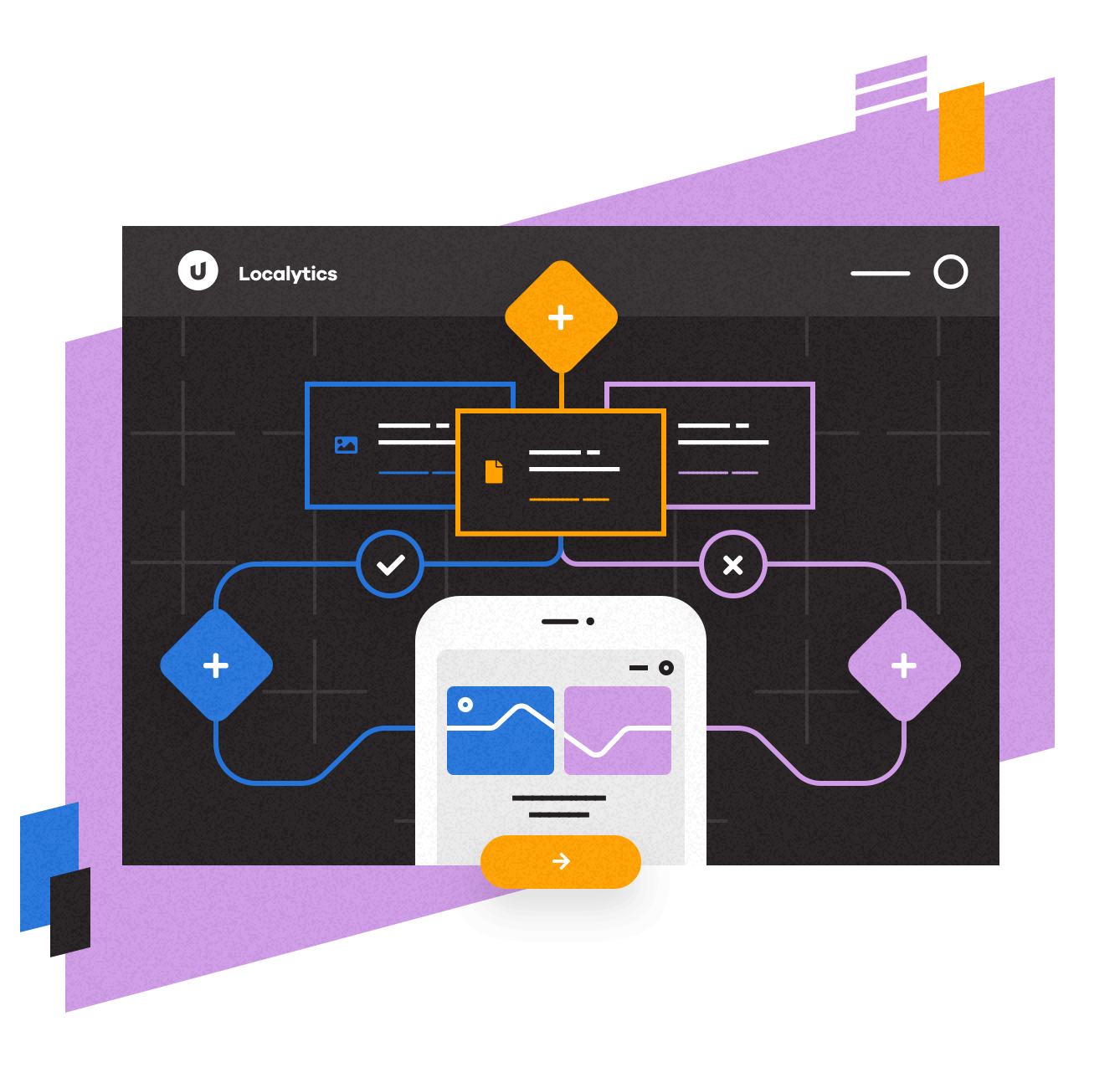

Mobile app marketing and analytics software

Deliver personalized mobile app campaigns that boost engagement, allowing you to connect with your customers on a deeper, more meaningful level.

The mobile marketing solution to create personalized mobile app experiences that drive engagement, loyalty, and conversion.

Gain a deeper understanding of your mobile app audience.

Know your customers inside and out with powerful app and mobile analytics so you can deliver the brand experiences they want and value.

- Discover what drives retention, revenue, loyalty, and conversions

- Understand and stop customer churn, app uninstalls, and encourage conversions using predictive analytics

Deliver the next best action through personalized experiences.

Craft campaigns personalized with in-app and external customer data

- Combine multiple layers of profile, behavioral and historical data for detailed audience segmentation

- Engage across a variety of mobile app channels including app and web push, in-app messages, and app inbox

Drive customer engagement and loyalty.

Keep customers coming back by delivering personalized experiences through effective onboarding, compelling offers, and engaging content.

Improve the app experience.

By knowing how your customers interact with your app, where they abandon actions, or what causes uninstalls, you can make informed decisions to continually improve your app.

Translate app marketing campaigns to meaningful ROI.

Understand how campaigns and messages impact conversions, revenue, engagement, and retention.

In the past year, we’ve seen over 50% of our reservations come through the app, and it’s really shown the importance of mobile for us. We use Localytics to understand and influence every stage of our mobile user journey, starting right from the download.

The 6 Ws of Personalization

Learn how to build a framework for intelligent personalization using the 6 Ws you learned in school.

Get great insights from our app analytics tools and deliver app experiences tailored to your audience.

Our software fits the unique needs of diverse industries and audiences to drive deep engagement.

Media & Entertainment

Create a seamless experience that captivates audiences across channels.

- Keep your audience informed with breaking news alerts

- Deliver personalized content recommendations based on user interests and behavior

Retail & eCommerce

Turn window shoppers into loyal customers.

- Put personalized deals, promotions, and new product alerts on your customers’ lock screen

- Increase conversion with abandoned cart campaigns

Financial Services & Insurance

Build customer relationships through personalized experiences.

- Create onboarding campaigns that empower customers to take control of their financial future

- Personalize messaging to guide customers toward the next best action

Travel and Hospitality

Create an app experience that feels like home, no matter where your customers go.

- Alert users of promotions for their favorite destinations

- Send the most relevant deals and promotions with location-based targeting

Telecommunications

Transform your business with an enhanced mobile experience.

- Craft customer journeys that increase loyalty and retention

- Prevent churn by using predictive analytics to act before customers drop off

Harness the power of connections

Extend customer engagement across all your touchpoints with powerful, seamless integrations

Movable Ink

- Personalize creatives in your mobile campaigns

- Enhance the personalization of your email creatives with mobile app data

Salesforce Marketing Cloud

Combine our app analytics and powerful mobile channels with your Salesforce marketing campaigns to deliver effective cross-channel engagement

Go beyond personalization

Get to know your customers and drive engaging 1:1 interactions

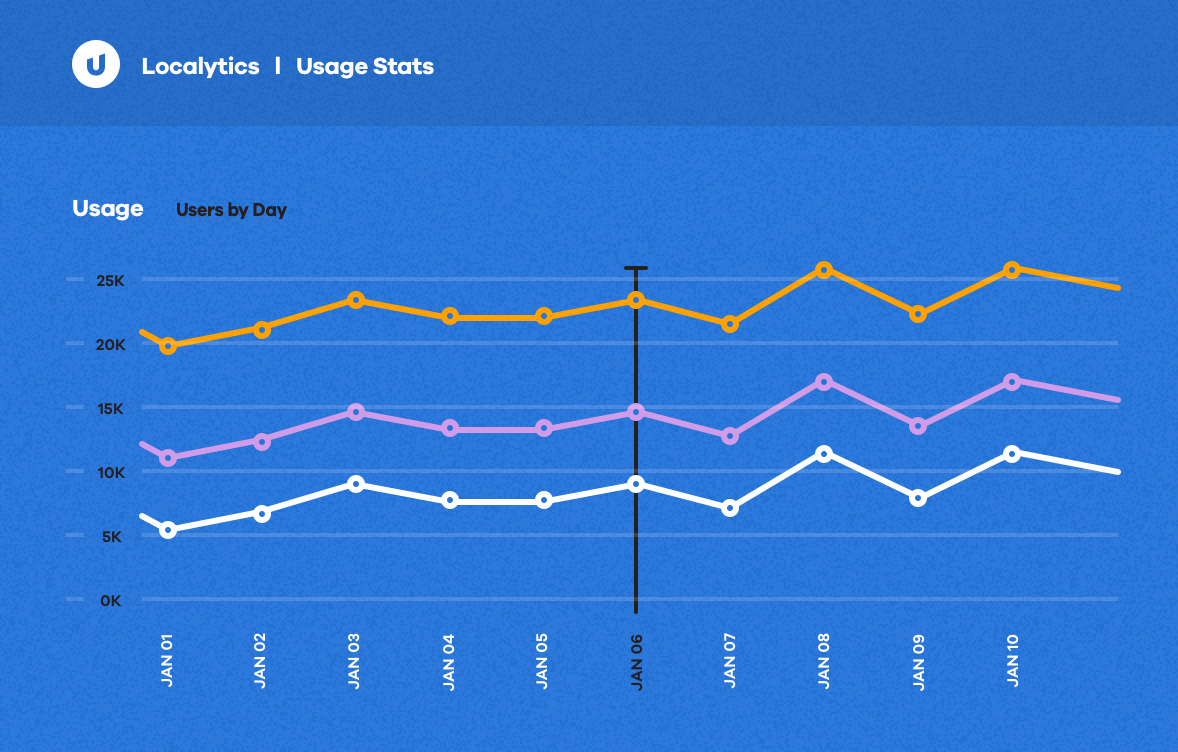

Rich Mobile App & Web Analytics

- Understand how your users are interacting with your app, watch for trends and correlations, and see how your engagement activities impact your customers

- Out-of-the-box and custom analytics reports

- Explore and filter through your data, access your raw data, and get industry benchmarks to provide more perspective on your results

- Save customers at risk of churning or encourage those on the verge of conversion with predictive analytics

Detailed Campaign Reporting

- Go beyond clicks and opens to understand engagement, retention, conversions, and impact on churn and uninstalls

- Improve ROI by knowing what is driving revenue and loyalty and what is bringing customers back to your app or website

- Iterate on and improve your engagement as you discover what resonates with your customers and what campaigns drive desired results

Powerful Mobile App Channels

- Engage your app users with personalized app and web push notifications, in-app messages, and app inbox

- Unify your customers’ digital and physical experiences using location-based messaging and analytics

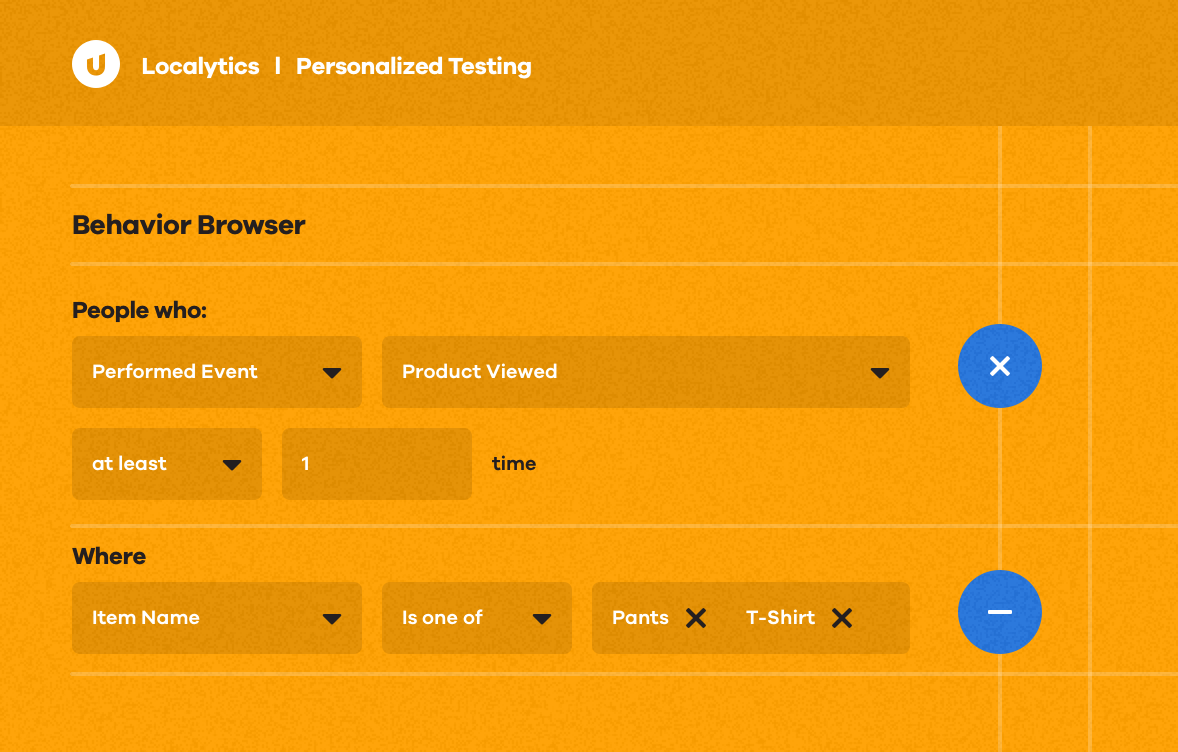

Intelligent Personalization

- Segment audiences using layers of profile, behavioral and historical information for precise personalization

- Create interactive experiences that reach across messaging channels using behaviorally triggered campaigns

- Take the guesswork out of your campaigns with optimization features like personal delivery time

- Know what messages resonate best with advanced A/B testing

Elevate your customer experience.

Pair Upland Localytics with other products to engage customers across every marketing touchpoint.

Private: Mobile Messaging

Text messaging software with feature-rich SMS, MMS, and mobile wallet.

Transform your customer engagement challenges into opportunities.

We’re your dedicated mobile app engagement partner, helping you develop the most impactful, results-driven campaigns to reach and exceed your goals.