In business, there are really only two things that you control; who you call on, and what you say when you get there. If you put the effort into deciding what customers you call on, you are much likely to be effective when you get there. This applies as much to individual sellers as it does to those responsible for developing the company’s strategic sales or marketing approach.

So, how do you decide where to spend your selling time in 2015? You need to decide where to prioritize your time, because not all account or opportunities (or markets) are equal.

How to Get Started

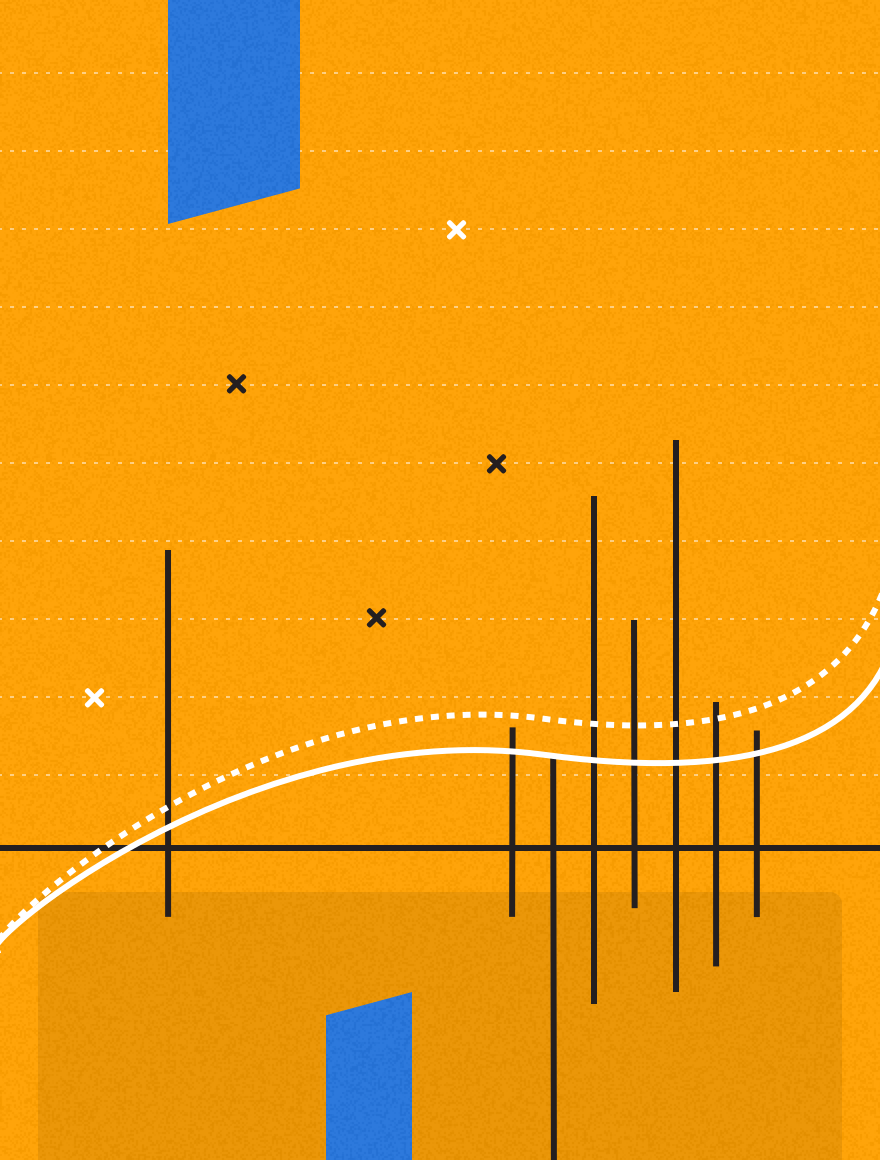

In the simple graphic here I have listed 10 companies that I am considering for my 2015 sales plan. Some of these will be existing customers and some are prospects. There will likely be a broad span of company types (and opportunity size) spread across these accounts. When I encounter a large account with a lot of potential I will likely want to develop a complete account plan for that specific account, but I will get to that in a separate post. In the first instance I should prioritize these 10 accounts based on Current Revenues and Future Revenues.

If you have read my book Account Planning in Salesforce you will know that I always view an account or a set of accounts as a market(place). In that market, you want to be the market leader, and you want to cover as many market segments as possible, but only where the return justifies the effort, and where you can achieve meaningful segment penetration. In an ideal world you would like to cover 100% of the market. Realistically, because resources are scarce and your time is at a premium, you have to make choices and prioritize your efforts in areas that will generate the most opportunity. Plotting each of these accounts using Current Revenues and Futures Revenues as your guide will help you to determine your prioritized areas of focus.

Current Revenues: This is a picture of the business you are currently doing with your existing customers. Obviously you want to record the sales you achieved in this account over the past year, but you should also be mindful of the profitability of that business and the level of sales resource required to win or service those deals.

Future Revenues: This is much harder to assess than Current Revenues because much of the data required is subjective. In the chart above I have created a simplified version of Future Revenues so that if you don’t have an automated tool to help you it may provide you with a framework to get started.

You need to understand the profile of the customer’s business; how are they performing? Is the market growing? Equally well, you should obviously pay attention to the Opportunity Profile in that account; is there a good solution fit? What is the strategic value? Are there known short-term needs etc.? Finally, you might also consider your Relationships in each of these accounts.

Where to Focus?

For my sample 10 companies I have plotted Current Revenues and Future Revenues for each. Based on this analysis I have categorized each into separate quadrants.

- In the A Quadrant, I have three accounts (Company 3, 4, and 7) where there are both high Current Revenues and an expectation of high Future Revenues. There is, in fact, a significant “gap” between our current situation and the revenue we could realize. If we don’t invest in these accounts it is likely that there will be a drop off in revenue. I should complete a full Account Plan for each of these accounts.

- You can see in the B Quadrant, there are also three companies, and here I expect that there will be high Future Revenues for each of them. Once more, as in the A Quadrant, there is a significant “gap” between our current situation and the revenue we could realize. These should be part of my 2015 sales plan.

- How I manage the accounts in the C Quadrant should now be a little different based on my analysis. The lower right-hand quadrant indicates there is no future potential over and above what we are currently getting. But you should consider how to protect your current revenue level and evaluate the consequence or impact if you don’t?

- The lower left-hand D Quadrant is an easy one. There is a little current revenue and little or no future potential and these two accounts (Companies 2 and 8) might best be left to the marketing department to manage and nurture.

Standardizing Your Approach

It is always best to have a clear definition in your company as to what determines the fate of each account. The elements I used to assess Future Revenues are likely to be a little different in your own company. (See below a screen shot from Dealmaker Smart Account Manager that shows a more detailed example.)

You should consider the elements that you care about for Current Revenues and Future Revenues and be clear on definition of each of the elements. For example, you might have an internal debate to determine what High, Medium, or Low means in the context of last year’s closed revenue. Depending on your current go-to-market strategy you make not be as focused on the Opportunity Profit History as others, and might want to weight it accordingly. Make a conscious decision and then apply it consistently across all your territory or portfolio assessments.

As I said at the outset; there are really only two things that you control; who you call on, and what you say when you get there. As you plan for 2015, I strongly suggest you apply the adequate effort in selecting what accounts you pursue. It is worth the effort and will free you up to spend your time wisely on accounts where you can maximize the return on your effort.

If you’d like to see how your pipeline is performing, consider using our free, online tool to calculate your sales velocity:

Follow me on Twitter or connect on LinkedIn.