As Mike Rosenbaum (EVP CRM Apps, Salesforce) said in the Foreword to my recent book, Digital Sales Transformation in a Customer First World, we are living in an era of unprecedented change. Mike also acknowledges that saying this feels tired, worn, and perhaps obvious. We all know we are living in a whirlwind. We are feeling the wind in our faces every day. It feels like it has been that way forever – and we just work harder and dig deeper to get our jobs done.

But this time it feels different and this time there are facts, not just opinion, to support Mike’s assertion – particularly when it comes to individual sales contributors, sales managers and sales executives who make their living in enterprise business-to-business sales.

The facts:

- The percentage of salespeople who make quota (53 percent) is at its lowest in more than seven years[1]

- Sellers are losing four out of every five deals they pursue[2]

- One million B2B sales professionals in the US will lose their jobs to self-service technology by 2020[3]

- The average sales win rate is 21.7 percent[4]

- One in five buyers say there is no need for sellers in the future[5]

- The direct cost to US sellers of meetings with customers that do not progress is $574B per year.[6]

On the other hand, progressive companies who deploy Digital Sales Transformation outperform Nasdaq and NSYE by 11 and 14 points respectively. That’s why I wrote this book.

If you are a sales leader, what do you see when you look around?

Stop. Look around.

What do you see?

Here’s some of what I’m seeing around the world, right now:

- Longer times for new sales hires to ramp and become fully productive

- Extreme deal slippage and surprise wins and losses

- Declining win rate and poor ROI on sales investment

- Severe friction between seller and sales manager / sales executive

- Customers treating more suppliers as vendors, not partners

- Pressure on customer retention and higher customer expectations

- Insufficient and poor quality pipeline

- Poor return from existing accounts with increasing pressure on incumbents.

If you recognize your company in any of these observations, you’re clearly not alone.

But why has it gotten so much harder than before? It’s not as if the world’s sellers have stopped working hard. I’ve not noticed a materially lower caliber of seller than I’ve seen in the past. It has always been hard to hire good salespeople. But now with such a low average win rate, companies need more coverage, and over-allocation of quota, just to standstill.

So, maybe Mike is right, at least in the world of sales. We are living in an era of unprecedented change. But what has changed? Well, the increasing pervasiveness of technology is obvious to everyone. Digital Transformation is knocking on your door, and tapping on your window. You can’t ignore that.

But the seismic shift is a consequence of the pressure being felt by our customers, and the ensuing change in their behavior. Maybe we are seeing a change in how customers want to buy. Let’s start there.

The Buyer’s Problem

Like everyone else, B2B buyers are living in a more challenging and more complex world. Not all sellers think about it that way. The pace of change by itself brings additional complexity and risk. It drives a need for even more intricate and involved solutions that deliver increasingly impactful business solutions to resolve those more complex problems.

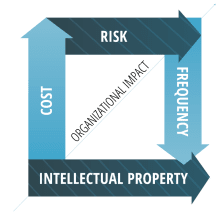

As cost increases and the complexity (intellectual property) of products or services being transacted grows, the greater the potential impact on an organization. As frequency of purchase decreases, organizational impact tends to increase. As risk increases with cost and complexity or IP value – for example, in the case of business infrastructure projects or a CRM system – organizational impact goes up, along with the buyer’s need to engage earlier and more intensively with sellers for guidance and input. The inverse is also true.

As cost increases and the complexity (intellectual property) of products or services being transacted grows, the greater the potential impact on an organization. As frequency of purchase decreases, organizational impact tends to increase. As risk increases with cost and complexity or IP value – for example, in the case of business infrastructure projects or a CRM system – organizational impact goes up, along with the buyer’s need to engage earlier and more intensively with sellers for guidance and input. The inverse is also true.

By extension, the opportunity for B2B sellers is to re-model their sales engagement, leveraging Digital Sales Transformation capabilities, to efficiently and effectively service the B2B buyer. Customers are already leveraging technology to optimize their buying activities. How a salesperson interacts with a customer to optimize the return from the sales effort ought to be informed by how the customer buys and the potential impact on the customer’s organization.

In my book, I introduce the Customer Impact Architecture model, a way to determine the impact on, or disruption to, a buying organization as a function of the complexity of the solution being purchased, the opportunity for organizational gain, and the potential organizational risk.

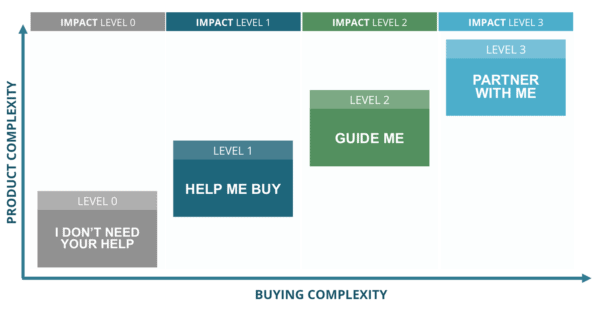

The model categorizes customer impact in four levels, easily identifiable by mapping Product Complexity and Buying Complexity.

The Seller’s Response

The challenges for the leadership of selling organizations are pretty clear. Firstly they need to embrace a Customer First approach and figure out how to map their sales engagement model to maximize customer impact. This is not about accepting that the customer’s buying model is best for the customer, or that the customer always knows what is in their best interest. The seller’s role continues to be about creating and communicating value, but doing so in a manner that is informed by the customer’s buying process and how they want to buy. As customers have evolved, sales organizations have invested in more headcount to try to catch up with their more progressive customers. This is one of the main reasons why the percentage of salespeople who are making their sales targets has continuously declined for the last seven years to just 53 percent today.[1]

To catch up with their customers, sales leadership must apply a model that optimizes the engagement between buyer and seller. As we work through the Customer Impact Architecture model you will recognize that a seller’s strategic value is directly proportional to the Customer Impact Level.

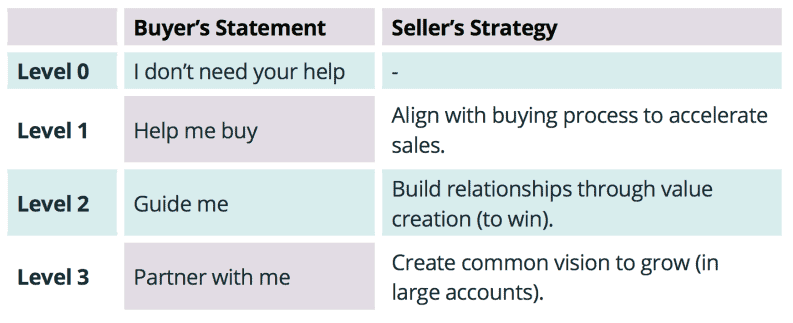

If the customer says: “Help me buy,” the sales organization’s complementary strategy should simply be ‘Align with Buying Process to Accelerate Sales. The table below shows how the seller’s strategies correspond to the buyer’s statements.

But, of course, the sales organization’s response cannot be limited to just Strategy. In this evolved world of Customer First engagement and Digital Transformation, there are four components necessary for a complete Digital Sales Transformation:It makes sense, I think, that if the customer’s perspective is “Help me buy,” the seller’s activities should help the customer buy. No rocket science there. This does not in any way imply that salespeople can abrogate their responsibility to create value for the customer, to understand their requirements and to prove how they can help solve the customer’s problem; but by recognizing that different customers buy different things, in different ways, to solve problems of varying complexity and organizational impact, sales organizations can design optimal models of engagement to maximize value for the customer and the seller.

- Sales Strategy

- Sales Execution

- Sales Management

- Digital Sales Transformation Technology.

Once the Customer Impact Levels are understood, the complete Customer Engagement Model incorporates strategy at a high level and technology underpinning everything else. Between strategy and technology, capabilities need to be honed by sellers to execute their sales processes, methodologies and skills, and by sales managers to instill a coaching culture and apply both an inspection and improvement framework.

Customers will continue to have more complex problems to solve. As they become digitally enabled they will expect their engagement with their B2B sellers to complement that capability. The disruption to sales organizations will continue unless sales teams understand and embrace AI and the other Digital Transformation technologies that can improve sales performance. They must also accept the need to continually self-educate to remain valuable to their customers and competitive in the market.

[NOTE: This is an extract from my new book Digital Sales Transformation in a Customer First World

[1] CSO Insights 2017 World Class Sales Practices Study.

[2] Inside the Buyer’s Mind.

[3] Forrester Research: Death of a (B2B) Salesman.

[4] Inside the Buyer’s Mind.

[5] Inside the Buyer’s Mind.

[6] Inside the Buyer’s Mind.