A customer calls with what sounds like a simple question. Does a deduction still apply this year? Has the threshold changed? Seems straightforward, but the answer depends on timing, income, and which version of the rule applies. And one wrong answer can create issues well beyond the call.

These moments are becoming more common for banks and credit unions. Not because tellers and frontline contact center agents are unprepared, but because the rules they are expected to guide customers through are constantly changing.

The Big Beautiful Bill, a federal law passed in July 2025, is one major reason these questions keep coming up. We’re here to demystify the challenges and highlight solutions to help tellers and agents stay in sync. Keep reading to see how the Big Beautiful Bill affects banking contact centers and how knowledge management helps teams keep up with changing rules.

Why Banks and Credit Unions Can’t Ignore the Big Beautiful Bill

The Big Beautiful Bill often gets framed around healthcare and social programs, but its impact extends well beyond those areas. For banks and credit unions, it reshapes tax policy, lending activity, and regulatory obligations in ways that affect daily operations and customer experiences.

A major shift comes from changes to the 2017 Tax Cuts and Jobs Act. With many provisions now permanent, customers plan further ahead with fewer assumptions about expirations. Over time, that changes borrowing, saving, and investment behavior, which then impacts:

- Lending demand across consumer, small business, and commercial products

- Deposit activity and account behavior

- The volume and type of customer inquiries

The bill also raises the federal debt ceiling by $5 trillion, adding long-term macro and rate sensitivity that financial institutions need to factor into planning and risk management. While debated nationally, these pressures show up locally in branches and contact centers for banking that serve communities and small businesses every day.

What’s Changing for Financial Services Under the Big Beautiful Bill?

The Big Beautiful Bill brings a mix of permanent and time-limited changes that affect financial products, internal operations, and compliance workflows. Some rules now stay in place for the long haul. Others come with expiration dates, income thresholds, and equity carve-outs. Together, these changes add more moving parts across lending, deposits, tax-adjacent products, and servicing.

Permanent rules reshape operations

Several provisions now run indefinitely. Rates, brackets, and select deductions no longer reset every few years. Planning horizons stretch further, but adjustments now arrive through new legislation instead of predictable sunsets.

Temporary rules add complexity

Alongside permanent changes, the bill introduces deductions and incentives with sunsets, phaseouts, and eligibility limits. These time-bound rules need tighter tracking and closer coordination across tax, lending, compliance, and servicing teams.

Where changes surface operationally

At a high level, the bill reshapes planning and incentives. On the ground, it affects how teams configure products, apply rules, and stay aligned. Here’s how key provisions play out in everyday operations.

| Change | What’s Different | What This Affects |

| SALT deduction cap | Raised to $40,000 from 2025–2029, then scheduled to revert | Requires year-specific guidance and close policy tracking |

| Estate and gift tax exemption | Increases to $15M per individual and $30M per couple starting 2026 | Expands planning workflows tied to trusts, transfers, and advisory coordination |

| Mortgage interest deduction | $750,000 cap made permanent | Locks in long-term product assumptions for mortgage teams |

| Bonus depreciation, Section 179, R&D expensing | Immediate expensing restored | Drives increased business lending and financing activity |

| Rural and agricultural real estate loans | 25% interest income exclusion introduced | Adds pricing advantages alongside new eligibility rules |

Taken together, these changes raise expectations. And that becomes most visible when customers ask questions and want straight answers in real time.

Why These Changes Show Up First in Contact Centers for Banking

Few industries put as much pressure on frontline teams as banking. Margins are tight, customer expectations are high, and even small mistakes can carry regulatory consequences.

Add to that the reality that banks are managing dozens, often hundreds, of active products and offers at the same time. The result is more inbound activity and less room for error.

Contact centers help customers make sense of changes

New deductions, eligibility thresholds, and phased timelines send customers to banks for explanations rather than federal agencies. It falls on agents to translate complex rules into practical guidance during live conversations, often across several products at once.

Temporary provisions drive more “what applies to me?” calls

Short-term rules create ongoing uncertainty. Customers want to know whether a provision applies this year, next year, or only at certain income levels. As sunset dates and phaseouts approach, repeat calls and interpretation efforts rise.

Product changes increase inbound volume

Product demand doesn’t shift quietly. Contact centers for banking are usually the first place these changes show up. Higher activity across auto, agricultural, commercial, and private student lending increases servicing and eligibility questions. New account types, such as Trump Accounts, add contribution rules, tax treatment details, and ongoing support needs.

How the Big Beautiful Bill Raises Risk for Financial Services Teams

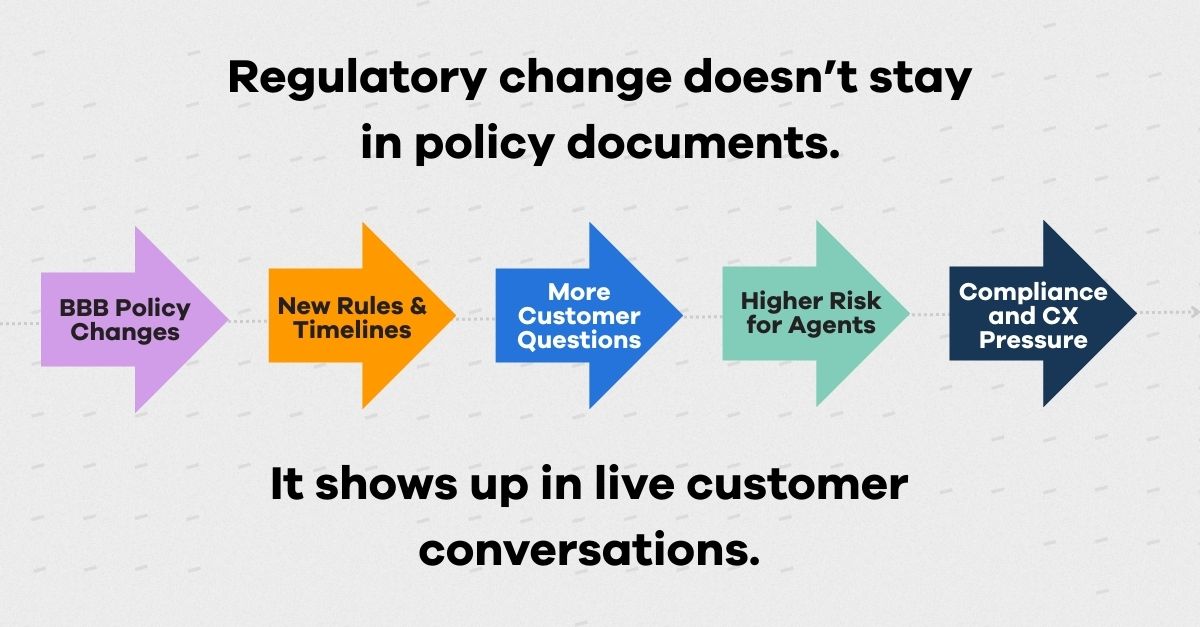

New requirements under the Big Beautiful Bill are not abstract. They don’t live only in policy documents. They show up in reporting cycles, customer conversations, and everyday frontline decisions. And, as BBB provisions roll out and guidance shifts, that pressure will build across banks and credit unions, and show up in a few clear ways:

- Execution and reporting pressure increase. New requirements, such as IRS reporting tied to auto loan interest deductions, come with firm deadlines and added documentation. When processes are unclear or uneven, mistakes and missed filings become more likely, increasing compliance exposure and rework.

- Accuracy becomes a trust issue as well as a compliance one. Banks are responsible for sharing correct, current information while meeting federal, state, and sometimes international requirements. Even small errors can weaken customer trust and raise regulatory risk, especially when guidance changes frequently.

- Inconsistent guidance carries legal consequences. When explanations about eligibility, deductions, or timelines vary across bank tellers or channels, routine service conversations can escalate. What starts as a simple question can turn into audits, disputes, or legal issues.

Beyond direct compliance risk, there’s added pressure, too. Cuts to Medicaid and SNAP leave many households with less cash on hand, especially in the communities banks serve. That makes customers more sensitive to lending decisions, fees, and even small account changes.

Use Case Scenario: A Bank Teller’s Stress Under the Big Beautiful Bill

Let’s look at one example of how these challenges can play out on the ground.

Emma is a regional bank teller struggling to navigate the changes brought by the Big Beautiful Bill. She’s a seasoned teller known for her efficiency and customer service. But since the BBB passed, her job has become significantly more stressful. Customers are flooding her branch with complex questions about new tax deductions, eligibility thresholds, temporary provisions, and more. For example:

- One retiree recently asked how the raised SALT deduction cap affects their property taxes.

- Another local farmer called with significant concerns about the 25% interest income exclusion for rural real estate loans.

Alongside her customers, Emma’s anxiety is sky high as she’s quickly becoming overwhelmed keeping on top of shifting rules and regulations. Her bank’s outdated knowledge base and scattered guidance have left her unsure if the answers she’s providing are accurate. She worries that even a small mistake is going to harm her customers, eroding trust and damaging relationships she’s built over years. Even worse, she knows that mistakes can lead to costly compliance risks.

Emma’s not alone. The BBB in banking increases uncertainty around deficits, interest rates, and what comes next, so customers start reaching out sooner and more often. That spike in questions quickly shows where static tools fall short, and leaves frontline tellers in a tight spot as they scramble to provide service.

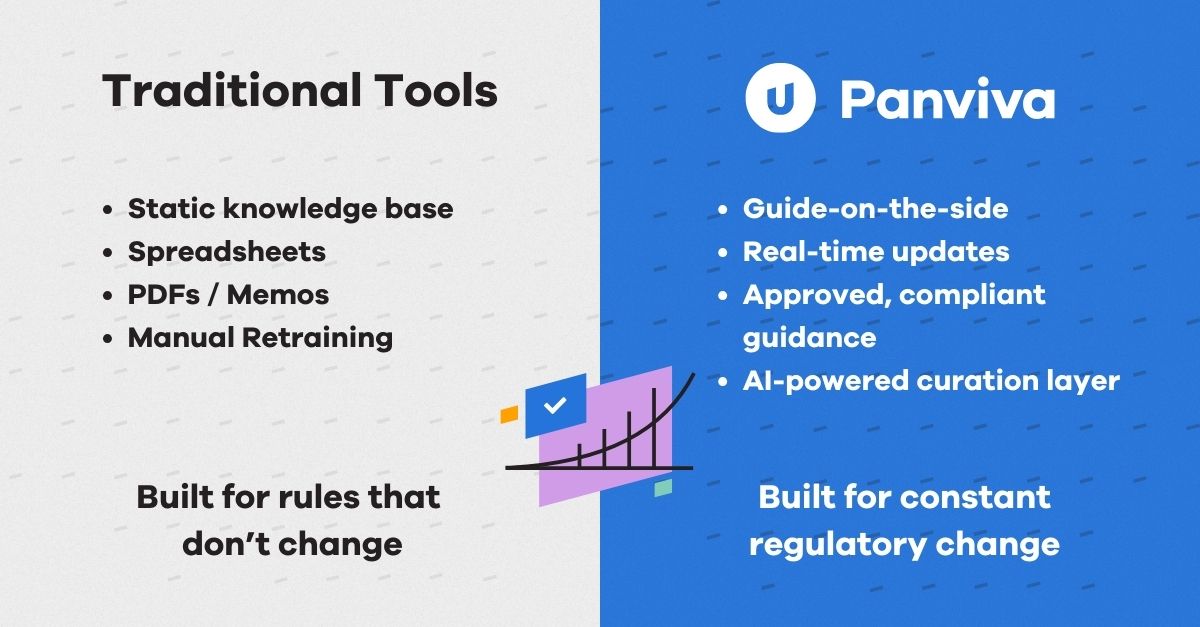

Why Traditional Contact Center Tools Start to Break Down

Most contact center software assumes the rules stay put. Under the Big Beautiful Bill, they don’t. Provisions phase in, expire, and rely on guidance that develops over time. That moving target exposes the limits of tools designed for static information.

Static knowledge can’t keep pace

Outdated knowledge bases struggle to keep up with frequent updates, sunset dates, and interpretive guidance as it’s released. As content ages, the risk of outdated or inconsistent answers increases.

Siloed information leads to mixed answers

When information is spread across tax, lending, and compliance teams, tellers and agents rely on partial or outdated guidance. Without a single source of truth, maintaining consistency across channels becomes difficult.

Training falls behind changing rules

Static training and scattered documentation are not built for rules that shift mid-year or guidance that changes in stages. Manual retraining operates on fixed schedules, while regulatory change unfolds year by year.

Together, these gaps show why tools designed for static rules start to break down. Under the Big Beautiful Bill, the challenge is less about access to information and more about keeping guidance current, consistent, and usable at the moment agents need it.

How Knowledge Management in Banking Helps Teams Keep Up

Regulatory change doesn’t arrive in neat cycles. More than 60% of the bill’s projected cost and several high-impact provisions take effect upfront, before temporary rules expire or guidance fully settles.

That early impact increases the volume and complexity of customer questions long before teams feel fully “done” with implementation. At a structural level, configurable knowledge management helps financial services teams handle ongoing change by:

- Maintaining a single, governed version of guidance as rules evolve

- Separating approved explanations from informal interpretation

- Making it easier to update guidance without rewriting training programs

- Reducing the risk that timing or eligibility details drift across teams

In financing contact centers, this plays out call by call. Agents handle eligibility and timing questions with less back-and-forth, even as details change. When guidance stays aligned, answers stay consistent. As rules keep moving, guidance has to keep pace.

How Panviva Supports Frontline Banking Teams

Frontline banking teams can’t wait for answers after the call. Support has to be easy to access, easy to follow, and simple to keep current as requirements change.

Panviva is built for that. It delivers compliant, approved guidance directly inside agent workflows, so bank tellers and agents can answer customer inquiries confidently without searching across systems, relying on memory, or stopping work to repeatedly retrain themselves on the latest policy shifts.

What this looks like in practice

Salem Five Bank shows how this works at scale. The bank supports complex, high-value transactions across multiple countries, currencies, and more than 50 systems, which makes keeping guidance current a daily challenge.

Before Panviva, knowledge was hard to access and slow to update. Manual processes increased risk, and guidance often lagged behind changing requirements. After implementation, teams could find guidance faster, follow it more easily, and keep it current across the organization. The impact showed up quickly:

- Faster updates as processes and requirements changed

- Fewer errors tied to outdated or inconsistent information

- Shorter time to competency for new hires in complex roles

Other banks, like Regional Bank, saw the same results. Teams accessed up-to-date guidance faster, corrected errors sooner, and tackled complex, multi-system tasks head-on.

Because Panviva is a browser-based contact center software with universal updates, teams stay up to date without long update emails or repeated training cycles. Sidekick, Panviva’s browser-based agent assistant, puts approved guidance right where agents work, helping them respond accurately during live conversations.

Why AI-Powered KM Solutions Are Mission-Critical in 2026

The BBB accelerates a problem banks already face. Regulatory change now moves faster than legacy processes, manual updates, and static spreadsheets can handle. With more moving parts to manage, AI-powered KM solutions like Panviva make it easier to stay compliant and respond quickly.

Panviva’s AI functionality removes the friction of traditional updates. Instead of waiting for a training cycle or a memo to circulate, leadership can push critical updates to every agent immediately.

Sidekick puts guidance where work happens. Tellers and agents ask a question in plain language and get a clear answer instantly, without breaking their flow. It feels like a trusted colleague nearby, with consistency built in. By showing what applies and when, Sidekick cuts search time, reduces rework, and helps lower handle time without losing accuracy.

AI-driven KM also gives leaders visibility into where guidance drifts or breaks down. With current, actionable information in place, banks can adjust faster and deliver consistent service as rules keep changing.

Be Ready When the Next Change Hits

Deloitte says it best, “2026 appears to be shaping up as a defining year for US banks.” The Big Beautiful Bill makes clear why. Regulatory change isn’t slowing down, and uncertainty is becoming part of day-to-day operations for banks.

Some organizations let uncertainty spill into customer conversations, frontline judgment calls, and cleanup work later. Others absorb it earlier through clearer ownership and tighter interpretation. The difference may not stand out right away, but it compounds over time.

That pattern shows up first at the frontline. Agents need guidance that’s easy to find, easy to trust, and current in the moment work happens.

With Panviva, agents rely on up-to-date guidance right where they work, even as requirements shift. Learn how real-time knowledge helps contact centres for banking keep up with change without slowing agents down.